Before deciding on an exact type of health insurance plan, it's important to know what kind of coverage is out there. While there are a lot of different ways to get health insurance, it's good to know what you may be eligible for before you start your health insurance search.

Group Health Insurance

The majority of people under the age of 65 have medical insurance through their employers' group insurance. According to the National Coalition on Health Care, in 2005, over 80 percent of employees were eligible for employer-group insurance and 83 percent of those who were offered, opted for these types of plans. This is usually because employers and other organizations can get better rates because they have a large number of people to cover. The insurance company sees it as good risk because they'll probably end up paying out very little for many people in the group, while collecting premiums from everyone. Normally, this translates into premiums that are much lower than those found in individual health insurance plans and are the same price for everyone in the group regardless of their health.

While employers aren't required by law to provide health insurance, they may have a difficult time finding good employees if they don't. Also, once group insurance is offered, it falls under the protection of the Health Insurance Portability and Accountability Act (HIPAA) regulations. These regulations protect employees by ensuring that everyone is given access to the employer's health insurance plan regardless of their health status. The act also helps regulate waiting periods of health plans to help achieve continuous coverage for most employees and helps ensure that employees have access to health care if they lose their job.

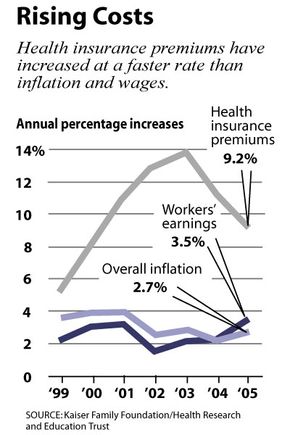

Because health insurance rates are re-negotiated each year based on the previous year's health care costs, some employers offer wellness programs for their employees. By keeping employees healthier, they can lower medical costs. Participation in these programs can sometimes make employees eligible for reduced health insurance premiums. For employees who pay a portion of the premium themselves (which is typical), this can mean eliminating some or all of that charge.

Most employer's group insurance plans are managed care plans, typically either HMOs or PPOs. Both of these types of plans will be explored in detail later in this article.

Individual Health Insurance

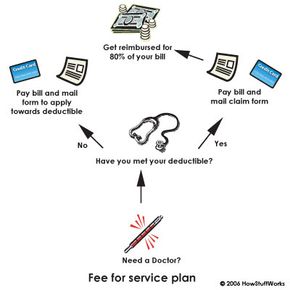

Individual health insurance is the most expensive option for people who don't have coverage (or don't have enough coverage) through employers. Physical exams and questionnaires are usually a part of the application process, so poor health can really make a difference in the cost and eligibility. Types of insurance plans include fee-for-service plans, PPOs, HMOs and catastrophic insurance. Many companies offer health insurance for individuals and specialize in short-term coverage to fill in between employer coverage.