Health Insurance

Whether you're choosing a doctor or trying to navigate health insurance jargon, these articles will help you understand the health insurance system.

What's the Difference Between Cardiac Arrest and a Heart Attack?

How the Graphene Blood Pressure Tattoo Will Change Monitoring

Is Polio Back? Here's What You Need to Know

Do You Have One of the 6 Rarest Eye Colors in the World?

What Happens When the Wind Is Knocked Out of You?

What Is Saliva and How Does It Change the Taste of Food?

12 At-home Date Night Ideas

Is Sapiosexuality a Real Thing?

The Myth of Closure: Why Experts Say It Doesn't Exist

FDA Approves OTC Narcan Nasal Spray for Opioid Overdose

Medical Schools Have Come a Long Way From Grave Robbing to Get Cadavers

Mark Cuban Wants to Solve the U.S. Prescription Drug Price Crisis

What's the Difference Between a Sociopath and a Psychopath?

Not So Funny: The Mysterious 1962 Tanganyika Laughter Epidemic

Lifelike Robo Pets Help Seniors Combat Loneliness

The Shocking Story of Lina Medina, Who Gave Birth at Age 5

What Did People Do Before Infant Formula Was Invented?

Spanking Has Declined Sharply in the U.S. in Last 25 Years, Study Finds

The Meaning Behind Semicolon Tattoos: A Symbol of Resilience and Solidarity

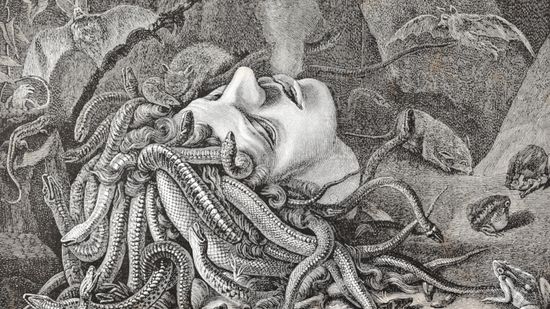

The Fascinating Meaning Behind Medusa Tattoos

20 Amazingly Practical Uses for Petroleum Jelly

Loud Films and Concerts Don't Have to Permanently Hurt Your Ears

How Many Miles Are In 10,000 Steps?