Health Insurance

Whether you're choosing a doctor or trying to navigate health insurance jargon, these articles will help you understand the health insurance system.

What's the Worst Day of Common Cold Symptoms?

What's the Difference Between Cardiac Arrest and a Heart Attack?

How the Graphene Blood Pressure Tattoo Will Change Monitoring

5 Least Painful Piercings (and 7 Extremely Painful Spots)

9 Least Painful Places to Get a Tattoo

The Biggest Nose in the World Was Over 7 Inches Long

5 Love Spells That 'Work' Immediately

10 Types of Love People Feel for Each Other

Birth Order Dating Theory: How Sibling Rank Affects Romantic Relationships

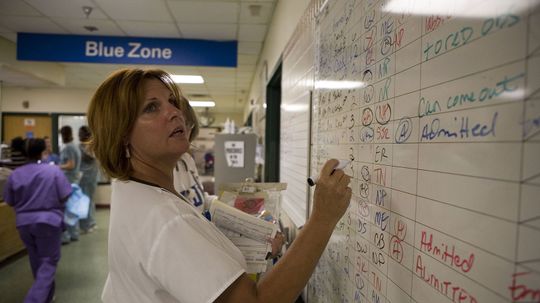

Who's the Most Powerful Doctor in the World? 5 Top Contenders

Thalidomide: How a Miracle Medication Became a Global Tragedy

10 Types of Drugs Used for Medicinal (and Illicit) Purposes

Demon Face Syndrome: A Rare Neurological Disorder

Unlocking the Mysteries of Seeing Dead Loved Ones in Dreams

10 Countries With the Highest Suicide Rates (According to the OECD)

10 Weird Pregnancy Cravings That Actually Make a Lot of Sense

Most Babies Born at Once Marked the First Nonuplet Survival

The Shocking Story of Lina Medina, Who Gave Birth at Age 5

Where Do Lice Originate From? Pardon the Head-scratcher

Semicolo Tatto Meaning: Symbolism, Origins, and Impact

Medusa Tattoo Meaning: From Myth to Modern Symbol

The Worst Bottled Water Brands Are Basically Filtered Tap Water

10 Types of Magnesium Supplements You Should Know

How to Clean Retainers for Optimal Oral Health

Learn More

Whether you're thinking about moving to one of the countries with the best healthcare or just curious how other nations handle health services, there's a lot to consider.

The No. 1 retirement worry is running out of money, and future health care costs can really make it hard to determine if you're saving enough. Long-term care insurance is one way to plan for the future, but is it worth the cost?

By Dave Roos

Medicare only covers so much. Health care costs can be very high for seniors in the U.S., even with this coverage. We look at two real-life situations to find out how people are coping.

By Alia Hoyt

Advertisement

Buying a Medicare Supplement plan (aka Medigap) can be a smart option for many people, but is it better than a Medicare Advantage plan?

It's one of those phrases bandied about by a variety of politicians. But what would it mean if the U.S. embraced this health care proposal?

By Dave Roos

It's called the direct primary care model, and doctors who've switched to it say it promises better patient outcomes and less bureaucracy. But not everyone is convinced.

By Dave Roos

In some states, health insurance giant Anthem has been making headlines for denying coverage to patients who use the ER for non-emergency matters. But what's a layperson to do?

By Alia Hoyt

Advertisement

Health care costs in America keep rising as deductibles get higher. But experts say they are ways to cut down on those big bills from hospitals.

By Alia Hoyt

There are many everyday services that health insurance in the U.S. will often not cover. Here are some of them.

By Dave Roos

Health care spending in America goes up enormously every year. Yet just a small number of people account for most of the money. Why is this and how can we rein that in?

By John Donovan

The health of Americans has continued to decline for decades causing a rise in insurance premiums. To combat this problem, businesses and insurance companies are implementing wellness programs offering incentives for employees to get healthy.

Advertisement

Most people with pre-existing conditions have a hard time finding health insurance. That's where high-risk health insurance pools come in. After all, if you're sick, you still need your medication.

The Health Insurance Portability and Accountability Act, or HIPAA, was enacted by Congress to help ensure both health coverage and privacy for patients.

Most Americans are covered by their employers' group health insurance. But what happens if they lose their jobs? COBRA health insurance allows people to continue their coverage, but on their own dime.

In the olden days, if you had surgery or had an accident, you could have spend several days -- or even weeks -- in the hospital. Today, you could be out in a matter of hours.

Advertisement

Ever wondered how your doctor decides what to charge for a particular service he performs? Is there anyone regulating how much money they can make?

How does a pre-existing condition affect your health coverage? There is no easy answer to this question -- it all depends on the specific condition, the health plan and your health insurance history.

A health insurance exclusion refers to anything an insurance plan doesn't cover, from drugs to surgeries. Exclusions can vary, so it's essential that you get to know the details of your plan.

Utilization review is a health insurance company's opportunity to review a request for medical treatment. The purpose of the review is to confirm that the plan provides coverage for your medical services.

Advertisement

Preferred provider organizations (PPOs) are the fastest-growing kind of health care plan. With more than 158 million Americans enrolled in a PPO this year, this plan has become the choice of more than half of all Americans with health insurance coverage.

Choosing the proper insurance plan is a huge decision. To find out what kind of coverage you need, and to avoid paying for what you don't, there are several questions you should carefully consider before you sign on the dotted line.

Thanks to advances in technology, more and more medical treatments are being made on an outpatient basis. But what qualifies as an outpatient service? How do they differ from inpatient benefits, and what does that mean for your insurance coverage?

Coinsurance is used in several different types of insurance, from property to health. The basic concept is that you and your insurance company share the risks.

Advertisement

A provider network is a list of physicians, hospitals and other providers that offer health care services to patients in a managed-care insurance plan. Managed-care plans are usually more affordable than other kinds of plans -- but they limit your freedom to choose your own doctors.

You've probably wondered what happens to all those forms you fill out at the doctor's office. Where do they go next -- and what happens if your insurance claim is denied?